The Local Element Lakeshore

What The Heck Is Happening In The West Michigan Real Estate Market?!

A quick recap:

It's been quite a rollercoaster of a year

Last year, at the beginning of September, our office met for our weekly team meeting and several agents were reporting a slow down in showings after 3 solid years of offer deadlines and multiple offers.

Then, seemlingly overnight, the market took a cliff dive. By October 2022 the average time on market for a home nearly tripled, from 24 days to an average of 80 days on market. 80 DAYS!

Sellers were upset, buyers were scared, and Realtors were in the middle sharing about how the Feds attempts to impact inflation had a direct impact on housing and that when inflation was under control demand would return because supply was still well below the need for housing.

In January, when interest rates and the shock of the fall market wore off Buyers re-entered the market. From January til July we saw a return of strong offers and seller friendly terms.

Below we’ll take a look a the numbers but all of this is to say we’ve had a solid first half of the year for sellers, we are still in need of more inventory for buyers, and as interest rates head up or down buyers will move with it.

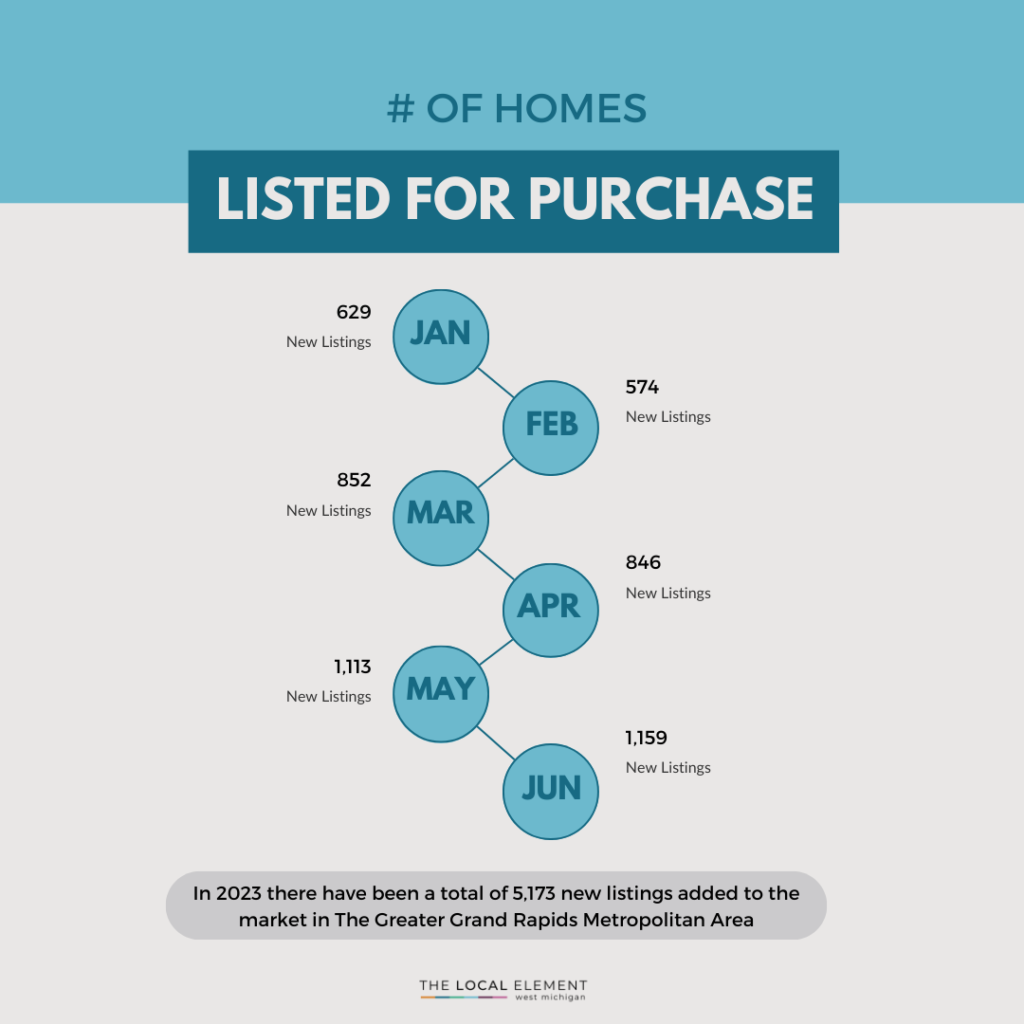

The number of homes for sale is increasing!

Despite home prices and interest rates spiking, there have been more homes put on the market since the pandemic. There have been 5,173 new homes listed since the beginning of 2023. This is a sign that the real estate market is returning to normal and stable conditions.

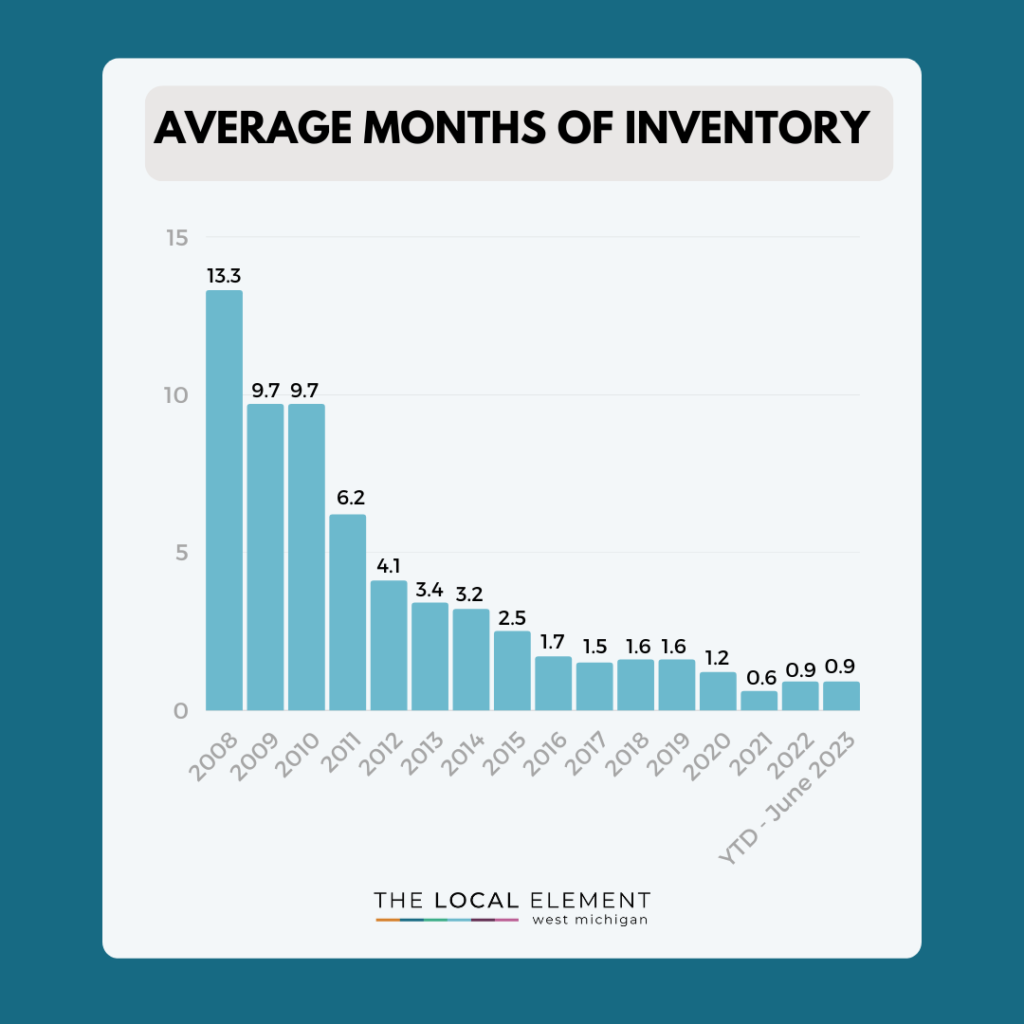

However, The Market is still Sweet for Sellers

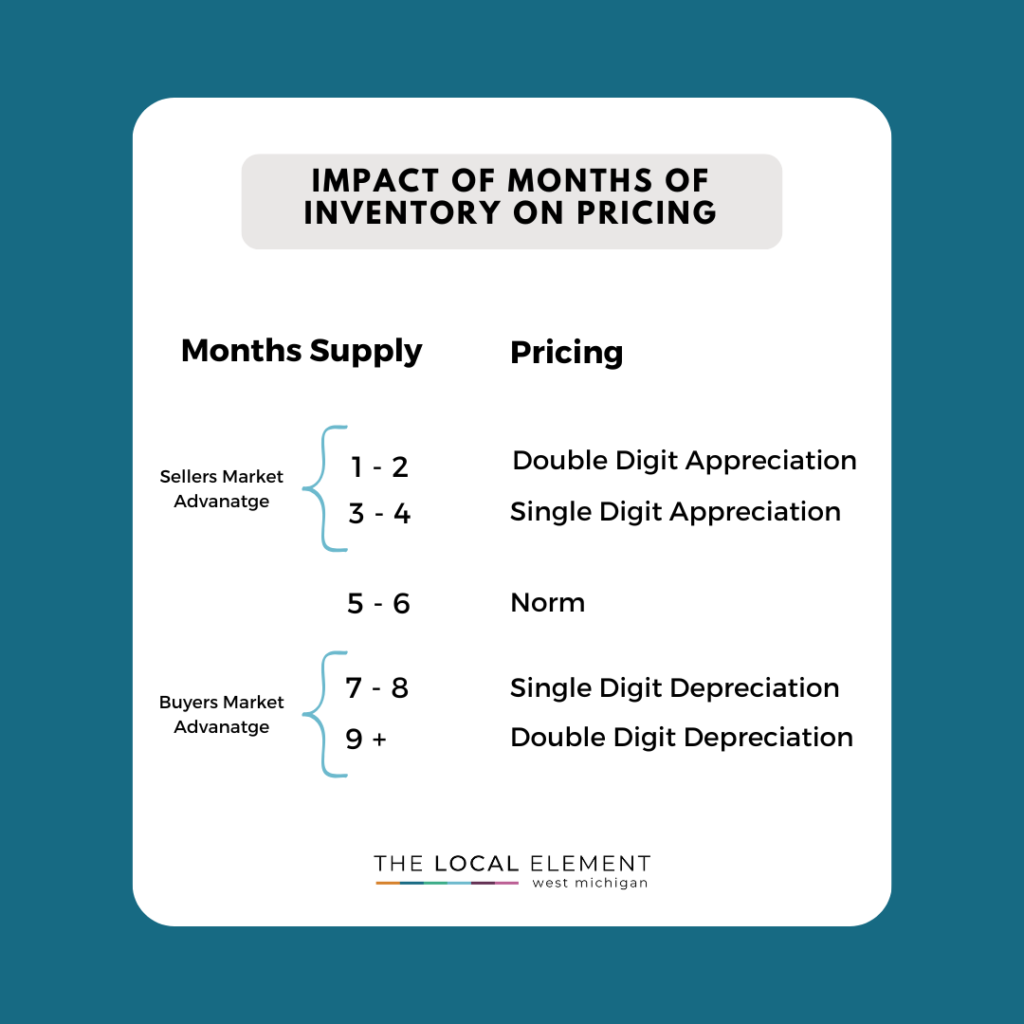

5-6 months of inventory is considered a balanced market for buyers and sellers. With only 0.9 months of inventory, the market is considered to be a seller’s market. When interest rates were below 4%, the demand for houses increased drastically. Now that we are seeing higher interest rates there are slightly fewer people interested in buying homes and therefore there is less competition.

home prices to continue to rise

Home prices in the Greater Grand Rapids area have increased drastically since January.

If you are a buyer waiting to save 20% towards a downpayment the appreciation from year to year on these house prices will keep pushing your line out. Many lenders are offering lower downpayment programs to make the entry point for first time buyers more affordable so they aren’t chasing the listing price increases.

However, it’s common to see homes sell for more during the summertime. The YTD average home price for June 2023 is $379,177, which represents a 7.8% increase compared to the same period in 2022 when the average home price was $351,797.

Stats from GRAR.com – Greater Grand Rapids Metropolitan Area includes the following: Kent County, Georgetown and Jamestown Townships in southeastern Ottawa County, Ionia County, the 6 townships in northeastern Allegan County, and the northern half of Barry County (including all of Gun Lake).

Looking to Buy or Sell a Home?

Learn more about buying a home !and selling a home in the Lakeshore or West Michigan real estate market

Fill out the form below to get connected to one of our Local Agents!

More to explore

Making Friends And Meeting People Along The Lakeshore | 2026

Making Friends Along The Lakeshore 2026 Moving to a new city means new experiences, new challenges, and making new friends! Wondering where

Buying A Home In The Winter: Everything You Need To Know

What You Need To Know About Buying a Home in the winter The spring market is often seen as the starting line

Winter Events Along The Lakeshore 2025/26

We can feel everyone itching for holiday magic and winter activities with all the snow we’ve had already! So, without further or